Electric two-wheeler sales reached 88,451 units sold, marking a 41% year-over-year increase but a 17% decrease from the previous month.

Key Highlights:

In July 2024, electric two-wheeler sales exceeded 107,000, showing a 97% year-over-year increase. However, August didn’t meet the industry’s high expectations, with 88,451 units sold, marking a 41% year-over-year increase but a 17% decrease from the previous month. This drop is attributed to the mid-month effect caused by the three-month Electric Mobility Promotion Scheme 2024 (EMPS), which is valid from July 1 to September 30, 2024. It is anticipated that September, the final month of the EMPS, will drive sales into six figures again.

The e-two-wheeler segment remains the largest volume contributor to the EV industry. In August, it represented 57% of India EV Inc’s total sales volume of 156,199 units, representing a 23% year-over-year increase, according to data from the government of India’s Vahan website as of September 1, 7 a.m.

The e-two-wheeler industry, similar to the e-three-wheeler sector, has experienced the impact of reduced subsidies, leading to price hikes from most EV manufacturers. This increase in prices may slightly decrease demand in the short term; however, the long-term cost-effectiveness of electric vehicles remains a significant attraction, especially when compared to the high price of petrol, which is currently at Rs 104.19 per liter in Mumbai as of September 1.

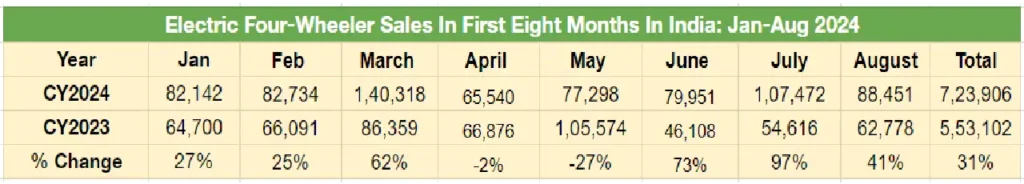

The e-two-wheeler segment, which accounts for the highest sales volumes in the Indian EV market, achieved a record sales figure of 860,365 units in CY2023. It is expected to exceed one million units for the first time in a calendar year in CY2024. As of August, the total retail sales stood at 723,906 units, marking a 31% year-on-year increase compared to the same period in 2023, where 553,102 units were sold. This accounts for 84% of the previously recorded sales figure for CY2023.

The sales data for the first eight months of CY2024 illustrates that the lowest monthly electric two-wheeler sales occurred in April 2024, with 65,540 units sold, following the discontinuation of the FAME II subsidy scheme on March 31. This also explains why March 2024 witnessed the highest e-two-wheeler sales, reaching 140,318 units.

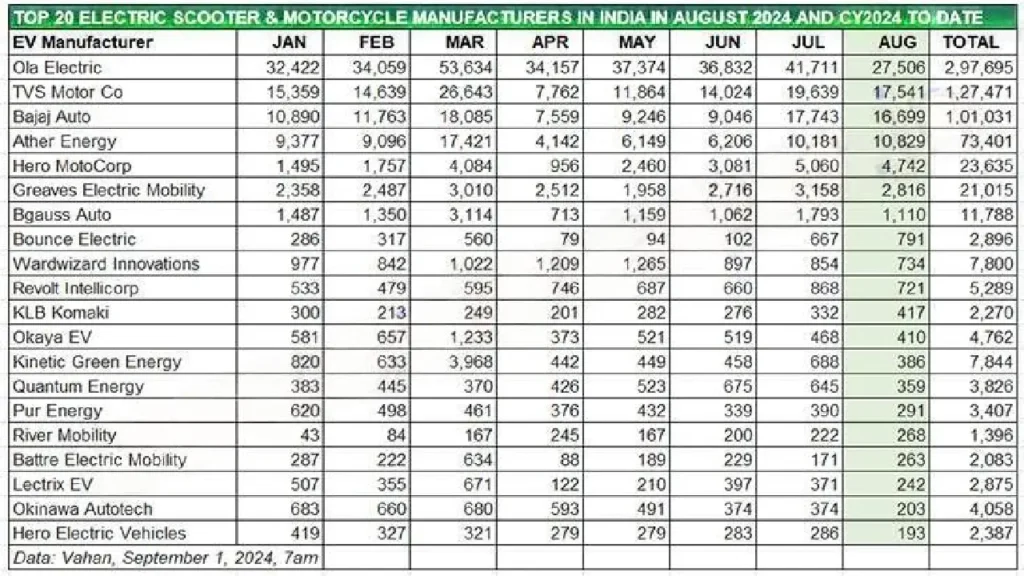

Now, let’s delve deeper into the performance of the industry’s top six key players in June and the first eight months of CY2024.

OLA Electric

Ola Electric, a leading player in the automotive startup scene, experienced a slower month with retail sales of 27,506 units, marking the lowest figure so far in the year. Although the numbers for August 2024 showed a 47% increase compared to the same period last year (August 2023: 18,749 units), they also represented a 34% decrease from July 2024, when sales reached 41,711 units.

TVS Motor CO

The second largest electric vehicle (EV) player in the two-wheeler segment, reported selling 17,541 units of its iQube e-scooter, reflecting a 13% year-over-year increase compared to August 2023. However, this figure represents a 10% decrease from the 19,639 units sold in July 2024. TVS Motor Co’s market share for August stands at 20%. From January to August 2024, the company has sold a total of 127,471 units, marking a 24% year-over-year increase and granting them a 17.60% market share year-to-date.

Bajaj Auto

In August, Bajaj Auto sold 16,699 Chetak units, marking a substantial 154% year-over-year increase compared to the low 6,582 units sold in August 2023.

From January to August 2024, Bajaj Auto’s Chetak sales totaled 101,031 units, a remarkable 201% year-over-year increase from the 33,497 units sold in the same period last year. This outstanding performance has propelled Bajaj Auto to capture a 19% market share, a significant jump from its 6% share in the previous year, placing them just one percent behind TVS Motor Co. Currently, Bajaj Auto is in close pursuit of TVS for the No. 2 position in the market, trailing by only 842 units.

Ather Energy

Ather Energy

Ather Energy exhibited steady growth, with 10,829 units sold, marking a 51% increase from the previous year. Compared to July 2024, the sales saw a 6% rise from 10,181 units to 10,829 units. Ather’s market share in August 2024 increased to 12% from 11% in August 2023. Notably, Ather achieved the milestone of selling over 10,000 units in both July and August this year.

However, the cumulative sales for the first eight months of the year remained flat at 73,401 units, compared to 73,160 units sold during the same period in 2023. This could be indicative of the intensifying competition in the market impacting Ather’s sales.

Hero Motocorp

The leading two-wheeler manufacturer globally has recently ventured into the EV market with its Vida brand of e-scooters. The company experienced a surge in demand, selling 4,742 units in August, marking a substantial year-over-year (YoY) growth of 419% from a low base of 915 units sold in the same period last year. Its market share has notably increased from 1.45% in August 2023 to 5.40%.

Greaves Electric Mobility

In August 2024, Greaves Electric Mobility sold 2,816 units of its new Ampere Nexus e-scooter, showing a 4% decrease compared to the same period last year when they sold 2,926 units. However, the cumulative sales for the first eight months of 2024 reached 21,015 units, marking a substantial 137% increase from the 8,853 units sold during the same period in 2023. As of now, the company holds a 3% market share.

GROWTH OUTLOOK

In August, electric two-wheeler sales reached 88,451 units, marking a 41% increase compared to the previous year. This is the third highest sales figure so far this year, trailing behind March 2024 (140,318) and July (107,472). Among the top six manufacturers, Ola, Bajaj, and Hero MotoCorp have already surpassed their total sales from the previous year. Ola is set to reach 300,000 units for the first time in a calendar year by the beginning of September. Bajaj Auto has exceeded its previous total sales, and Hero MotoCorp’s sales have more than doubled.

The three-month EMPS subsidy scheme will end on September 30, likely resulting in electric scooter and motorcycle sales surpassing 100,000 units again. While the first half of the month is expected to have rapid sales due to festivals, the second half might be slower. Even so, similar to the FAME II policy ending, September is expected to see increased marketplace activity. It’s uncertain whether it will be a record-breaking sales month, but we’ll have to wait until the end of the month to find out.ELCTRIC Speaks

Ather Energy

Ather Energy