India’s electric 4W sales report segment weathered a mixed May 2025. With strong long-term expansion offsetting a short-term fall in monthly volumes. Below is an in-depth examination of the numbers, trends, and competition molding the segment.

4W Sales Report Market Overview

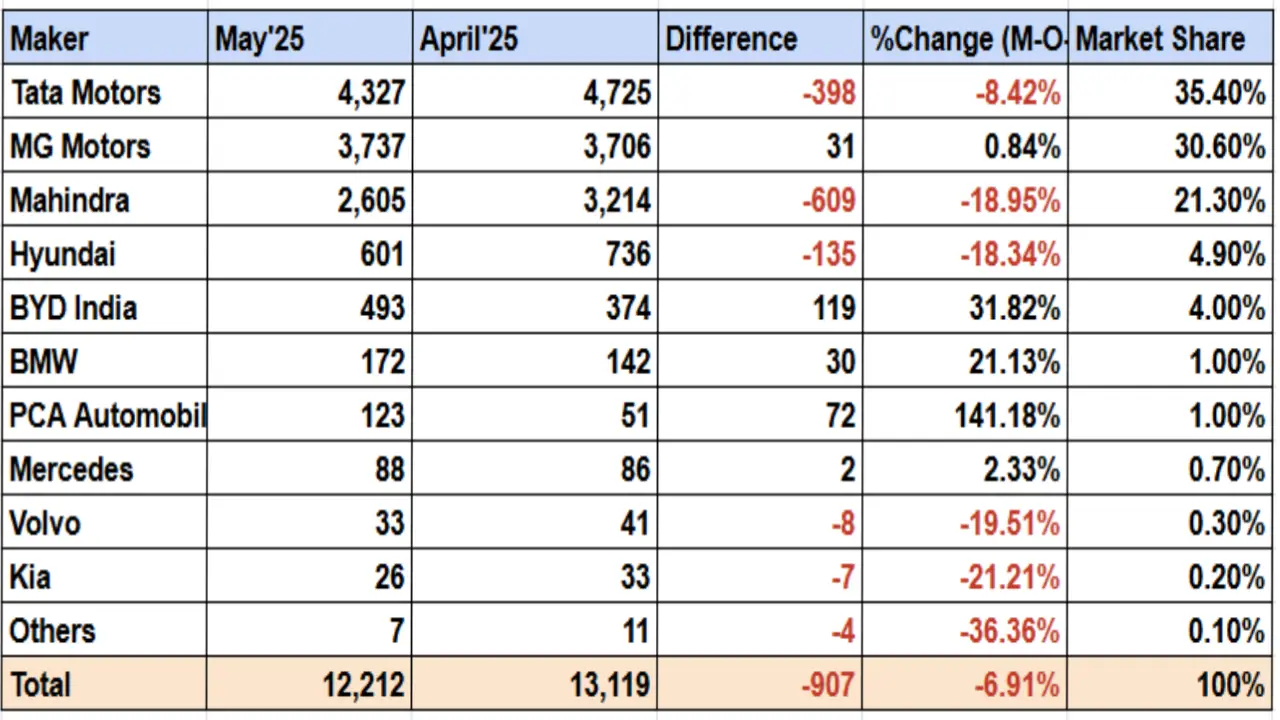

- Total E4W Sales: 12,212 units registered in May 2025. Down slightly from April’s 13,119 units. Though this month-on-month drop, the segment continues on a robust growth curve. With total electric car and SUV sales running 44% higher in the first five months of 2025 versus last year.

- EV Penetration: Electric four-wheelers represented 4.1% of total passenger vehicle sales in May. Increasing from 3.5% in April, indicating increasing consumer acceptability. OEM focus on electrification.

4W Sales Report Notable Trends

- Tata Motors is still the decisive leader but sees more intense competition from JSW MG Motor. Which has greatly reduced the gap to just 587 units in May.

- Mahindra & Mahindra continues its upward momentum. Driven by strong consumer interest in its new electric models.

- Hyundai’s Creta Electric launch has paid off. With the brand overtaking BYD in monthly volumes for the first time.

- Maruti Suzuki continues to lag, with no electric models in its portfolio as of May 2025.

Market Insights on 4W Sales Report

- Growth Factors: The growth of the segment is driven by increasing consumer sentiment. Enhanced charging facilities, and increasing availability of EV models at various price points.

- Short-Term Dip: The minor dip in E4W sales between April and May is viewed as a one-time blip. With the long-term perspective for the segment remaining bullish in light of the 44% YoY. Growth over the first five months of 2025.

- OEM Strategies: Established players are stepping up EV technology, local production, and after-sales services. Investment in an attempt to grab the next set of adopters.

ELCTRIK Speaks

May 2025 saw the promise and challenge of India’s electric four-wheeler industry. While overall monthly sales fell marginally, year-to-date growth in the industry continues to remain strong. Rivalry is intensifying as MG Motor is on the verge of overtaking Tata Motors long-standing leadership position. With Mahindra, Hyundai, and BYD also increasing their footprint. Overall EV penetration continuing to grow. The next few months are likely to prove critical for the future of electric mobility in India.