India’s electric 2W sales segment posted a strong performance in May 2025. Reaching key sales landmarks and recording significant changes in market leadership. Here is a complete summary of the segment’s performance, players, and upcoming trends.

Electric 2W Sales: Key Headline

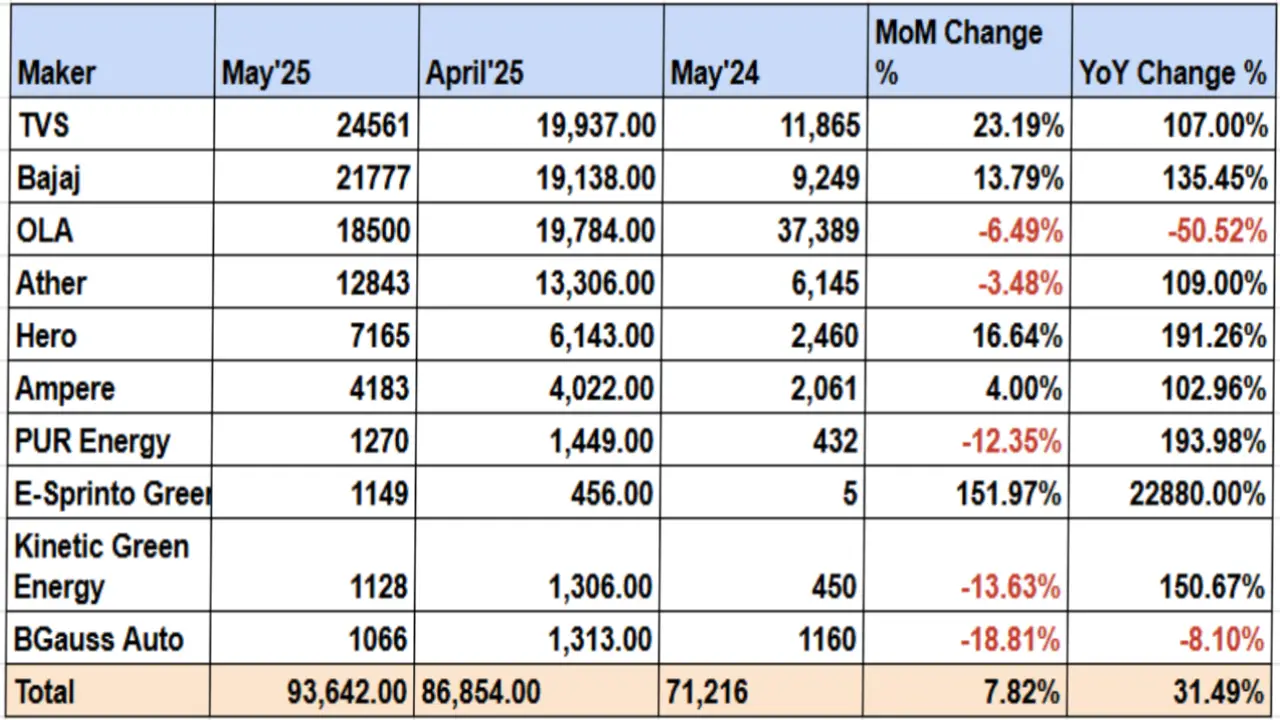

- Combined high-speed electric two-wheeler (E2W) sales in May 2025: 93,642 units.

- This is a 7.82% month-on-month and a 31.49% year-on-year growth.

- E2Ws represented about 56% of total EV sales in India for the month.

Electric 2W Sales: Key Insights and Trends

- TVS Motor Company was the undisputed market leader. Claims almost one quarter of the market. Its iQube model range, increased dealer count, and recent price cuts have boosted demand. Propelling TVS into the top spot ahead of previous market leader Ola Electric.

- Bajaj Auto’s Chetak also maintained its impressive pace. Doubling its market share year-on-year. As it gained from design refinements and enhanced availability.

- Ola Electric experienced a sharp fall in sales and market share with respect to last year. Due to internal restructuring, dealer problems, and regulatory issues.

- Ather Energy continued to grow steadily, retaining its premium urban market leadership. With high-growth brand Hero MotoCorp’s Vida slowly building presence.

- The growth of the segment was backed by continued government incentives under the new EMPS 2024 program. Although the vehicle-wise subsidy has been lower than at previous FAME 2 levels.

Electric 2W Sales Industry & Policy Context

- The Indian E2W market remains supported by government incentives. Such as subsidies for locally manufactured vehicles and components, reduced GST rates, and state-level incentives.

- The fresh EMPS 2024 scheme provides ₹5,000 per kWh (up to 15% of ex-factory price). For E2Ws, with a total outlay of ₹333.39 crore over four months.

- Resilience of the market can be seen in continued sales growth. Fresh product launches by both traditional and new players despite lower incentives.

Expert & Journalist Commentary

Industry watchers point to changing consumer demand for recognised brands. Offering sustained after-sales services and wider dealer networks. TVS and Bajaj’s leadership is symptomatic of the trend. Emerging players such as Ola and Ather are reshuffling plans to regain their vigour. The lowering of subsidies has not lowered demand substantially. Signals increased consumer trust in electric mobility as a mainstream urban commuting solution.

ELCTRIK Speaks

May 2025 was historic for electric two-wheelers in India. Sales crossed the 1-lakh mark and conventional makers firm up leadership. The consistent growth in the segment, in the face of changing policy paradigms and competitive pressures. Indicates a mature market ready for growth as India ramps up its sustainable mobility transition.