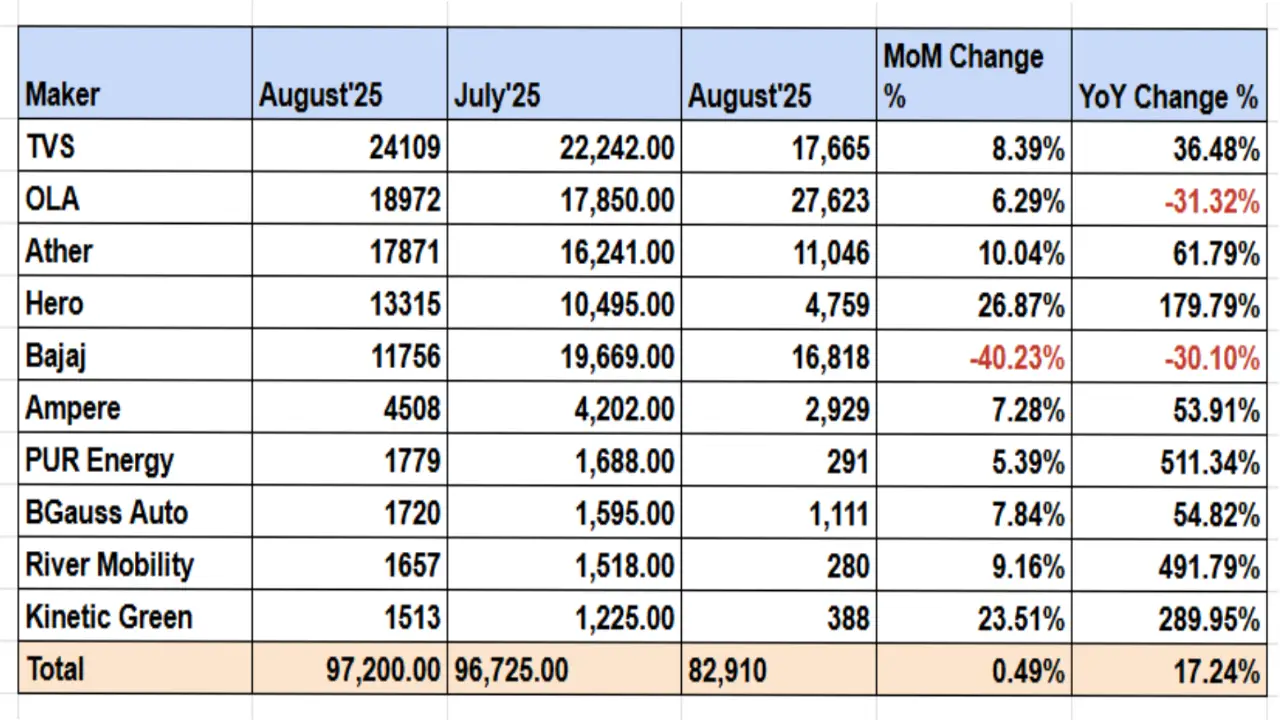

The Indian Electric 2W Sales clocked strong sales of about 97,200 units in August 2025. Evidencing strong growth trend in the industry in the wake of continued EV uptake momentum and prolonged subsidy support. August witnessed a healthy year-over-year growth of about 36-41% in volumes. From last year’s corresponding period despite some easing off from higher July 2025 sales levels. Electric vehicle adoption in the two-wheeler category continued high at a level of 8-9%. Reflecting increased customer demand and company initiatives towards electrification.

Electric 2W Sales: Top Brands and Sales Performance

- TVS Motor Company retained the top spot for the fifth month in a row. Selling approximately 24,087 units in August 2025. Such sustained dominance comes fueled by its iQube range of electric scooters, with year-on-year growth of 36-37% in sales.

- Ola Electric recaptured the second spot with about 18,972 units sold. Although Ola’s sales dipped by 31% year-on-year from previous highs. It recorded a recovery from recent lows. Which indicates a persistent competitive battle in the premium electric scooter market.

- Ather Energy recorded a record third spot with about 17,871 units sold. Posting a robust 65% year-on-year sales growth. This indicates growing market acceptance of its premium electric scooters.

- Hero MotoCorp, whose expanding electric scooter models like the Hero Vida entered the top four. For the first time with sales of around 13,315 units. Recording a remarkable 180% hike from last year, highlights Hero’s foray into EVs aggressively.

- Bajaj Auto recorded its electric vehicle sales falling sharply to fifth position with sales of about 11,756 units. Declining 30% year-on-year. Production problems caused by shortages of rare earth magnets impacted its Chetak electric scooter sales.

- Other industry players such as Greaves Electric Mobility sold about 4,508 units. Demonstrating continued growth among smaller producers.

Electric 2W Sales: Market Trends and Insights

- The EV 2W market demonstrated resilience despite supply chain issues impacting some makers.

- Increased product variety, better infrastructure, and Battery-as-a-Service (BaaS) solutions helped drive growth.

- The race is heating up among incumbent automakers (TVS, Hero, Bajaj). New-gen startups (Ola, Ather), with market positions changing on a month-to-month basis.

- Government incentives and subsidies continue to be important in driving consumer demand.

- The rising trend in EV two-wheeler sales indicates anticipated growth to pick up pace. As the category advances towards mainstream acceptance.

ELCTRIK Speaks

This sales report combines the most recent extensive data from major government registration sources. Industry reports for August 2025 in India’s electric two-wheeler industry.