Key highlights:

In August, retail demand for electric four wheeler declined 10% in the passenger vehicle market, following the overall trend. Tata Motors witnessed a 14% year-on-year decrease with 4,085 units sold, capturing a 64% market share. The cumulative sales from January to August reached 62,931 units, marking an 18% increase. Additionally, sales of luxury electric vehicles dropped by 14% to 155 units.

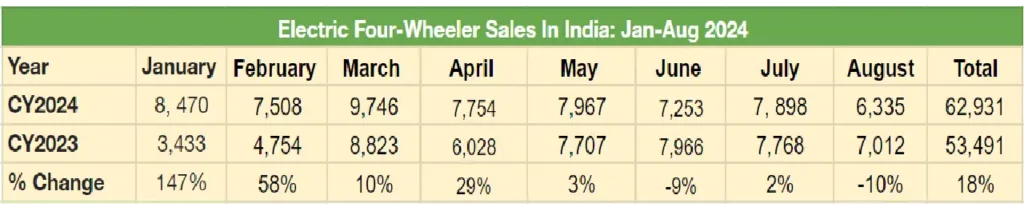

Specifically focusing on electric passenger cars, SUVs, and MPVs, retail sales reached their lowest point of the year in August 2024. Only 6,335 units were sold, showing a 10% year-on-year decrease from August 2023. Compared to July 2024, the sales declined even further by 19%. This data is based on the retail sales information available on the Vahan website as of September 2, 7 am.

Looking at cumulative sales, the total electric four-wheeler sales for the first eight months of the year totaled 62,931 units, marking an 18% year-on-year increase from January to August 2023, during which 53,491 units were sold. Notably, these sales figures already account for 76% of the total sales of 82,494 units in the previous year. It’s anticipated that the electric passenger vehicle industry will surpass the 100,000 retail sales milestone for the first time with four months still remaining in the year.

In August 2024, retail sales of electric passenger vehicles (ePVs) dropped to 6,335 units after consistently exceeding 7,200 units for the past three months. The cumulative sales for the first 8 months of 2024 represent 76% of the total sales in 2023.

Notably, CY2024 achieved strong sales of 8,470 units upon its launch, experienced an 11% decrease in February with 7,508 units sold, and then reached a peak of 9,746 units in March FY2024-ending. Subsequently, sales remained below 8,000 units for the following four months.

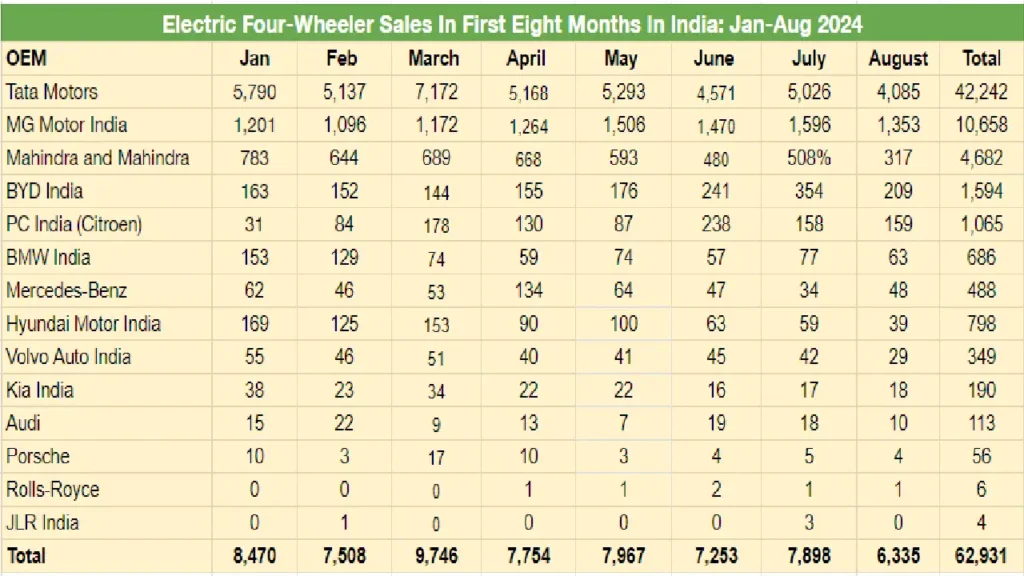

Tata Motors reported a sales figure of 4,085 EVs in August 2024. This reflects a 14% year-on-year decline from the sales figure of 4,777 EVs in July 2023, illustrating intensified competition in the market. Furthermore, Tata Motors’ ePV market share decreased from 68% in August 2023 to 64% in August 2024.

During the cumulative eight-month retail sales period of January-August 2024, Tata Motors sold 42,242 units, marking a 6% year-over-year increase (compared to the 39,909 EVs sold during the same period in January-July 2023). At this point in the current calendar year, Tata Motors has achieved 70% of its total projected sales volume of 60,000 units for CY2023.

MG Motor India, a subsidiary of the JSW Group, achieved significant sales success in August by selling 1,353 units of its ZS EV and Comet EV, resulting in a notable 21% market share, up from 17% the previous year. The company is expanding its electric vehicle (EV) lineup with two new models, a five-door SUV and a compact MPV, both based on the E260 EV platform.

In August 2024, Mahindra & Mahindra (M&M) secured the third position among OEMs with the sale of 317 XUV 400 electric vehicles, representing their entire EV sales. This resulted in a 5% market share, down from 6.45% in July 2024 when they sold 508 units. However, M&M’s year-to-date sales for the first eight months of the year reached 4,682 units, marking a significant 95% increase compared to the same period in 2023, when they sold 2,393 units.

On the other hand, BYD India, renowned for selling the Atto, e6 MPV, and introducing the Seal sedan on March 5, secured the fourth position in both August 2024 (209 units) and the January-August 2024 period (1,594 units) among EV OEMs.

Electric four-wheeler sales declined in August 2024 compared to the previous year. However, cumulative sales from January to August increased by 18%. MG Motor India seems to be doing well in the market, achieving a notable 21% market share. It’s also fascinating to see the expansion plans for electric vehicle sales networks across India.ELCTRIK Speaks