Key Highlights:

- EV financing in India must increase from 2% to 18% by 2070: CSI Report.

- India’s auto sector could create a $19.7 trillion market by 2070.

- Tamil Nadu is emerging as the top destination for EV investment.

- Battery localization and R&D investment are critical to achieving net-zero emissions.

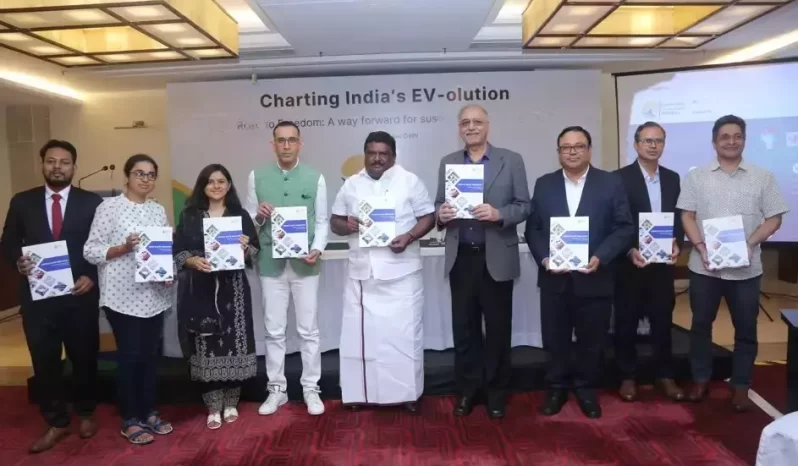

India’s path to achieving net-zero emissions by 2070 demands a substantial increase in automobile financing, especially in the electric vehicle (EV) sector. According to a report by the Climate and Sustainability Initiative (CSI), a global research firm, automobile financing must rise from 2% to 18% by 2070 to support localization, research, and development (R&D), manufacturing, and other critical aspects necessary for the country’s EV-olution.

The Need for Increased Financing

Another multi-faceted message conveyed in this report is that for achieving India’s net zero it is paramount that a sustainable financial strategy is established from the central government and other financing entities. This capital will play an important role in improving various activities that are not seen much in the nation yet such as; localization, research, and development, and manufacturing among others. Pursuing the CSI report targeting at such assumptions that the auto sector’s EV-olution can lead to a market opportunity of more than USD 19. This market is expected to get to $ 7 trillion by 2070 and among all products, the passenger vehicle or cars is deemed to gain popularity.

The report indicates that automobile financing needs to escalate significantly to address the low proportion of financed vehicles. From 2021 to 2070, the highest finance quantum will be required for cars, amounting to USD 7.1 trillion, followed by trucks at USD 1.9 trillion and two-wheelers at USD 653 billion.

Localisation: Tamil Nadu as a Key Player

There is a need for auto component Localization and advanced technological improvement as the current costs of investing in EVs remain high which slows down the chances of their adoption in the market. The report has emphasized Tamil Nadu as one of the key investment destinations, with leading companies such as Vinfast, Hyundai Motor India, Tata Motors, Ather Energy, Omega Seikki Mobility, and Ola Electric already present in the state. The climate that the Tamil Nadu government has created for Industries along with the Infrastructure facilities has made it favorable for such investments.

One of the most significant areas requiring investment is battery localization. EV batteries account for nearly 40% of an electric vehicle’s cost, making them a critical factor in the overall affordability of EVs. The Central Government has initiated several schemes to address this issue. The report estimates that by 2030, the demand for EV batteries will reach 225 GWh, with electric two-wheelers driving the demand for 117 GWh.

Also Read: Ola Electric Set to Electrify India’s Motorcycle Market

Investment in R&D and OEMs

The report also highlights the need for substantial investment in R&D to meet the growing demand for EV batteries. The annual demand for battery replacements is expected to rise significantly, from negligible in 2025 to approximately 788 GWh by 2070. To meet this demand, India will need to invest USD 1 billion by 2025, increasing to USD 41 billion by 2065.

Original Equipment Manufacturers (OEMs) will play a critical role in decarbonizing the automobile industry. The report estimates that OEMs will need to invest an average of USD 323 billion by 2070, starting with USD 7 billion by 2025. The passenger vehicle category is expected to receive the highest share of this investment, with the truck category anticipated to invest over USD 45 billion by 2070 to meet rising domestic demands.

ELCTRIK Speaks

The realization of India’s 2070 net zero emissions plan is upheld largely on stepped-up automobile financing with a special focus on EVs. It can form a market of 19 USD billion and produce substantial revenues for the shareholders. The country needs to come up with ways to promote localization, R&D, and manufacturing since it currently sits at around 7 trillion. Tamil Nadu is an investment hub and the requirement for massive capital investments for battery regionalization and OEM organization will go a long way to facilitate the Indian EV-olution. The CSI report, therefore, becomes a blueprint that shows the problems and the way forward for India if it is to realize its lofty environmental ideals.