Key Highlights:

Electric two-wheeler sales surged to 106,949 units in July 2024, with a 34% increase from June’s 79,868 units and a remarkable 96% rise from July 2023’s 54,616 units. This growth was attributed mainly to the Electric Mobility Promotion Scheme 2024 (EMPS), initially scheduled to conclude on July 31, prompting consumers to accelerate their purchases.

However, on July 26, the government extended the EMPS subsidy scheme by an additional two months, pushing its expiration to the end of September. Despite this extension, the top 4 original equipment manufacturers (OEMs) in July remained unchanged, with Ola Electric holding the leading position, followed by TVS Motor, Bajaj Auto, and Ather Energy.

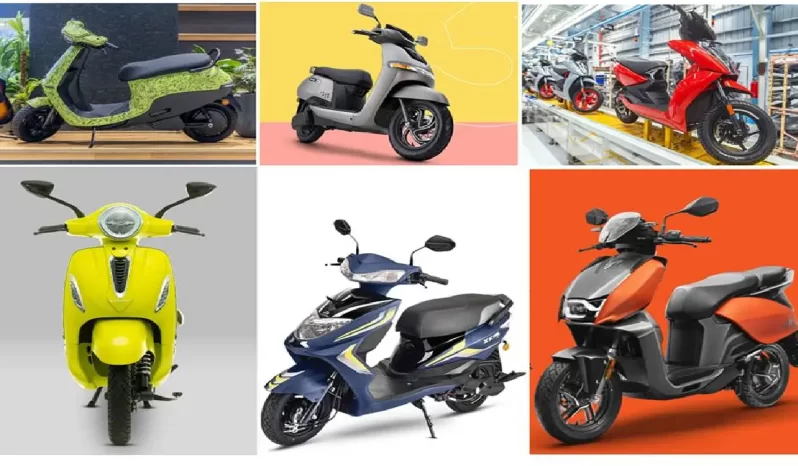

Top 10 Electric 2 Wheeler Companies by July 2024

Let’s quickly review the top 10 OEMs that achieved impressive sales in July.

OLA ELECTRIC

In July 2024, the company achieved remarkable retail sales of 41,597 units, demonstrating a 114% YoY growth and capturing a substantial 38.89% market share. Ola Electric’s upcoming IPO is scheduled to be launched on August 2, maintaining its dominant position in the market.

The company’s successful foray into the mass-market sector with the S1 X portfolio has driven its sales growth. The S1 X electric scooters, available in three battery configurations (2 kWh, 3 kWh, and 4 kWh), are priced at Rs 74,999, Rs 84,999, and Rs 99,999, respectively.

Furthermore, the company has recently adjusted its S1 Pro, S1 Air, and S1 X+ prices to Rs 129,999, Rs 1,04,999, and Rs 89,999, respectively.

TVS MOTOR

TVS Motor Co secured the second position in July by selling 19,471 iQube e-scooters, which accounted for an 18.21% market share. The company experienced an 87% YoY growth from July 2023 to July 2024. Additionally, on May 13, TVS introduced new variants of the iQube, expanding its range in the market.

TVS Motor aims to substantially increase the contribution of EV sales to its total volumes over the next two years. It anticipates that electric two-wheeler sales in India will reach 30% market penetration by CY2025.

BAJAJ AUTO

Bajaj Auto has reinforced its position as the third-largest e-two-wheeler OEM, trailing behind Ola and TVS, by selling 17,642 Chetak units in July. This represents a significant 327% YoY growth and secures a 16.50% market share.

The company’s two Chetak variants, Urbane (priced at Rs 123,319) and Premium (priced at Rs 147,243), continue to experience strong demand due to increased production capacity and an expanding dealer network. With a current presence in 164 cities and 200 touchpoints, Bajaj Auto is aiming to expand to approximately 600 showrooms within the next three to four months.

In addition, the company is gearing up to launch a new mass-market e-scooter under the Chetak brand, further strengthening its market position.

ATHER ENERGY

Ather Energy secured the fourth position in sales, with a significant rise from 6,685 units in July 2023 to 10,080 units in July 2024, indicating a remarkable 50.8% growth and capturing a 9.43% market share.

In April, Ather introduced the Rizta, priced between Rs 109,999 (Rizta S) and Rs 149,999 (Rizta Z), and commenced deliveries on July 4. Noteworthy specifications include the Rizta S with a 2.9 kWh battery and a range of 123 km, while the Z variant features a 3.7 kWh battery with a range of 160 km.

The scooter boasts the largest seat in Indian two-wheelers and offers ample storage space. Furthermore, Ather announced the establishment of a new facility in Aurangabad Industrial City (AURIC), Maharashtra, with an investment exceeding Rs 2,000 crore. The facility is intended to manufacture up to a million EVs and battery packs annually.

HERO MOTORCORP

Hero MotoCorp has achieved the fifth position, experiencing a 409% YoY sales growth from 990 units in July 2023 to 5,044 in July 2024. This growth has enabled the company to capture a 4.72% market share.

Hero MotoCorp, a significant early investor in Ather Energy and a key player in Ather’s growth since 2016, has increased its stake by 2.91% in Juy 2024, leveraging the rising demand for Ather products.

GREAVES ELECTRIC

Greaves Electric has secured the sixth position, experiencing a 46% YoY growth in sales from 2,159 units in July 2023 to 3,154 units in July 2024, capturing a 2.95% market share. The Ampere Nexus electric scooter, targeted at families, is a recent in-house innovation from Greaves Electric’s Ranipet facility in Tamil Nadu.

This electric scooter is powered by a 3 kWh LFP battery. It offers a top speed of 93 kph and a certified range of 136 km. It is available in two variants, with prices ranging from Rs 110,000 to Rs 120,000 (ex-showroom).

Also Read: Toyota Reopens Booking for Innova Hycross ZX and ZX(O) Hybrid

BGUASS AUTO

Bgauss Auto has achieved the seventh position in the ranks. The company experienced substantial sales growth, with numbers increasing from 661 units in July 2023 to 1,792 units in July 2024, representing a significant 171% YoY growth and obtaining a 1.68% market share.

The manufacturer recently introduced its latest electric vehicle, the BGauss RUV 350, offered in three variants: RUV 350i, RUV 350 EX, and RUV 350 Max. The pricing ranges from Rs 1.10 lakh for the base model to Rs 1.35 lakh for the top-spec variant.

REVOLT INTELLICORP

Revolt Intellicorp secured the eighth position in sales, with a notable increase from 484 units in July 2023 to 868 units in July 2024. This indicates a robust 79% YoY growth and captures a 0.81% market share.

The Ministry of Heavy Industries has granted official approval to Revolt Motors, rendering the company eligible for the Central Government’s EV subsidy schemes. This approval encompasses participation in the Electric Mobility Promotion Scheme (EMPS) 2024 and positions the company to benefit from the upcoming FAME III subsidy scheme, expected to succeed EMPS.

WARDWIZARD INNOVATIONS

WardWizard experienced an 86% YoY increase in sales from 458 units in July 2023 to 852 units in July 2024, resulting in a 0.80% market share for the company. Additionally, WardWizard recently entered into a Memorandum of Understanding (MoU) with Beulah International Development Corporation, based in the Philippines, securing a substantial $1.29 billion order.

As per the MoU, WardWizard will supply its current electric two-wheeler and three-wheeler models to the Philippines and develop new four-wheeler commercial vehicles tailored for the Philippine market. The company is expected to fulfill this order valued at Rs 10,800 crore over the next three years with a production capacity of 4-6 lakh two-wheelers and 40,000-50,000 three-wheelers annually, .

KINETIC ENERGY

Kinetic Energy’s Kinetic Green E-Luna sales increased from 232 to 687 units from July 2023 to July 2024, marking a 196% YoY growth and securing a 0.64% market share. Spy shots reveal that Kinetic Green Energy is expanding its electric scooter lineup with a new model currently undergoing testing.

The upcoming scooter boasts a high-performance suspension system featuring a front telescopic fork and twin rear shock absorbers. It is designed for enhanced stopping power efficiency and has a front disc brake and rear drum brake system. The scooter also features a single-piece grab rail, a hub motor, and a comfortably contoured seat capable of accommodating two individuals.

ELCTRIK Speaks

The electric two-wheeler sales surged, significantly increasing from the previous year. Ola Electric held the leading position, followed by TVS Motor, Bajaj Auto, Ather Energy, and Hero MotoCorp in the top five positions. The Indian electric two-wheeler market is witnessing substantial growth, backed by innovative products and strategic investments by key players.