Key Highlights:

- Zero Customs on Several Critical Rare Earths

- PLI & ACC Allocations Get a Massive Raise

- Fame 3 is Coming Soon

- Modi Govt Says Goodbye to Angel Tax

The Indian Government has finally unveiled the Annual Union Budget 2024. The budget consists of several allocations and exemptions that may prove extremely beneficial for the growth of the Indian EV sector and startups or companies working in the field of EV, Battery, and Charging. Let’s have an in-depth look at all the EV sector-related provisions in the union budget 2024.

Zero Import Duties on Critical Minerals

With the 2024 Union Budget, the central government has waived customs duties on 25 critical minerals. The list includes lithium, copper, cobalt, graphite, platinum, palladium and other rare earth elements. All these minerals are extremely crucial for the EV industry and other sectors.

This move by the Indian Government is expected to lower the manufacturing costs of batteries, cells, charging equipment, electronics, etc, consequently reducing the prices of electric vehicles and related products for consumers. According to some industry experts, this move can help in reducing battery prices by over 20%. Additionally, the finance minister also proposed to reduce the basic customs duty (BCD) on two of the above-mentioned critical materials.

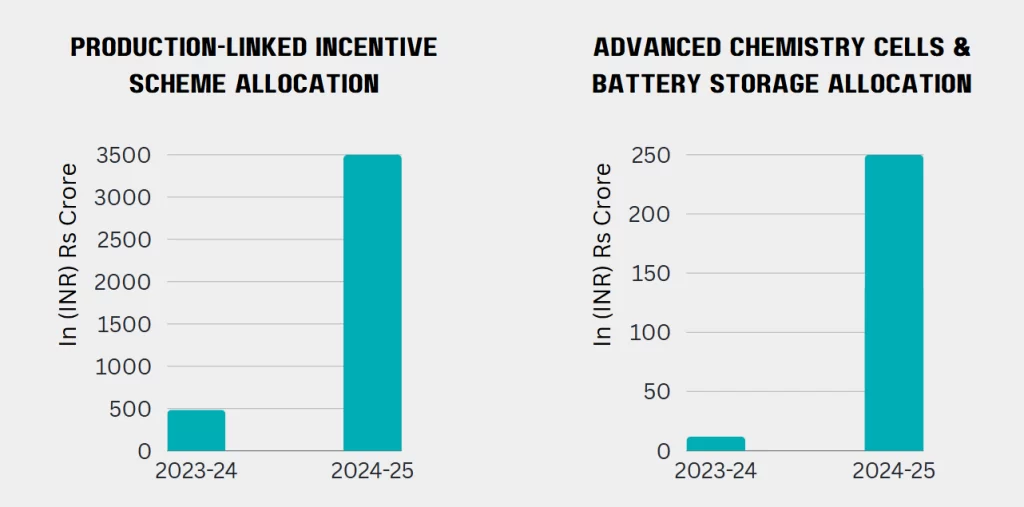

Production-Linked Incentives (PLI) Gets A Boost

The Modi Government has given a big boost to the PLI (Production-Linked Incentive) scheme by increasing its budget allocation to Rs 3,500 crore for 2024-25. This is a massive increase of 623.484% when compared to the 2023-24 allocation of Rs 483.77 crore. Moreover, the government has also raised the budgetary allocation for advanced chemistry cells (ACC) and battery storage. It has been raised from Rs 12 crore in FY 2023-24 to Rs 250 crore in FY 2024-25. That’s a massive 1983.33% increase.

FAME 3 With Massive Allocation Is Expected Soon

There was no mention of the FAME 3 scheme and the finance minister only reiterated the Rs 2,671 cr allocation for the remaining liabilities of the FAME 2 scheme which expired in March 2024. However, the FAME 3 scheme is not dead yet. According to several government sources, the ministry is working on FAME 3 and will likely announce it in the next few weeks if not months.

As an interesting matter of fact, the Minister of Heavy Industries – HD Kumaraswamy had already hinted last week that the so-called FAME 3 scheme would not be announced in the Annual Union Budget 2024. Also, according to some media reports, the FAME 3 scheme is supposed to come with a massive allocation of Rs 10,000 crore.

Angel Tax On Startups Abolished

One big decision that the Modi Government and the Ministry of Finance have taken is to abolish the angel tax on startups for all classes/categories of investors.

According to Section 56 (2) (7b) of the Income Tax Act, when a startup or an unlisted company raises capital by issuing shares to investors at a price that is more than its fair market value, that extra amount is treated as income and is taxed at 30.9%.

The removal of the angel tax is likely to propel the Indian startup ecosystem and boost the country’s entrepreneurial spirit. Ultimately, this will breathe new life into the startup ecosystem by attracting more investment from investors, angels & VCs, and pushing for more innovation & R&D in every sector/industry.

Also Read: What’s In For The Indian EV Sector In The Union Budget 2024-2025?

ELCTRIK Speaks

All four points mentioned above will truly be crucial for India in achieving its sustainable development & self-sufficiency goals. To some, these decisions might not seem to be of much help in the short term. However, in the long run, these will prove to be fundamental in achieving India’s energy independence, net zero and EV penetration targets.

Along with the EV and automotive sector, these allocations & exemptions will also propel the growth of companies, startups and MSMEs working in the field of battery, charging, electronics, semiconductors, solar, energy storage, components, etc. The exemptions related to critical minerals will increase their availability and supply, resulting in a reduction in production costs, thus boosting the Make in India initiative along with creating more jobs for Indians.

1 Comment

Nice and informative article!